Every freelancer or small business owner has been there. You complete a project, send out the invoice, and get back nothing but silence. Maybe your invoice is sitting forgotten in your client’s inbox. Or, perhaps, they’ve chosen to skip out on paying you for your work. Fortunately, carefully crafting your invoice wording for immediate payment can help you separate the former from the latter.

But does how you word your invoices really affect your clients’ actions?

True, the language in a contract or invoice should — first and foremost — cover your legal bases. But the wording you use with a client can also encourage or discourage them to act in a certain way.

By carefully choosing what you do or do not include in a invoice, you can subtly encourage clients to pay their due balance on receipt.

This might sound like the work of skillful manipulation, but it’s a lot easier than you probably think.

Why You Should Push for Immediate Payment

If you’re established in your field and have a nice nest egg set aside, you might not be too concerned with how quickly your clients pay their invoices. But for the up-and-coming freelancer or small business owner, a client paying their bill can be the income that keeps food on the table.

Even if you don’t rely on clients paying their invoices to pay your monthly bills, waiting for a client to submit payment isn’t fun.

For small contracts, chasing down payment can feel like a waste of time. And for large contracts, waiting for your client to pay their balance can be anxiety-inducing.

Oftentimes, it feels like your client is delaying payment just to toy with you. But that (normally) isn’t the case.

Clients have busy schedules of their own and, depending on the type of client, might need to forward your invoice to someone higher up for payment. Unfortunately, this often leads to invoices being forgotten, overlooked, or prematurely filed away.

If you can encourage your clients to pay their invoices on receipt, regardless of the due date, both you and your client can relax knowing that everything is in order. And in most cases, choosing the right invoice wording is the best type of encouragement.

Tips for Choosing the Perfect Invoice Wording for Immediate Payment

Creating invoices that encourage immediate payment sounds great in theory, but you’re probably wondering the best way to accomplish this in practice.

Here’s how:

Use a professional template

How do you invoice your clients? If the answer is by sending them a plain email stating their balance and due date, it’s time to change it up.

Requesting payment in a normal email, regardless of how formal your language, can inadvertently send the message that your client’s due balance isn’t a pressing manner.

After all, it’s a lot easier to ignore a wordy email than a clear and concise bill.

Using a professional invoice template can sometimes feel intimidating or unnecessary, especially if you run a fairly casual gig. But with the help of invoicing software, like invoicely, creating these documents can be just as easy as drafting an email.

Include a personal message

Just because you use a formal invoicing template doesn’t mean you shouldn’t include some kind of personal note to your client. In fact, doing so can remind your clients that you’re a real person who is relying on their payment to bring home a steady income.

This message doesn’t need to be overly complicated or involved.

A simple thanks for their business and prompt payment is all it takes to encourage your client to settle their bill immediately.

Provide clear payment instructions

When crafting your invoice wording for immediate payment, it’s important to put yourself in the client’s shoes. If there’s any confusion on their end about how to pay their due balance, they’re much more likely to put off payment until a later time.

Fortunately, it’s easy to solve this problem before it occurs.

When creating an invoice for a client, make sure to include clear instructions on how they can settle their bill. This will help encourage prompt payment and head off any confusion.

If you use an online payment portal for your business, include a hyperlink to this portal in your invoice or a separate email to your client. You’ll be surprised how quickly your clients pay their invoices when all it takes is a simple click.

Make the due date obvious

Some clients will delay payment regardless of when the invoice is due. Others, though, will always pay their balance on time. That is, if they know the due date in the first place.

Always ensure that your invoices’ due dates are clear and easy to find.

If the due date on your invoice is unclear or difficult to find, your clients might take advantage of this by paying their balance whenever they like.

For invoices that list the payment terms as a timeframe (for example, payment due 30 days after receipt), always include the actual due date as well. It’s a lot easier to overlook an approaching due date when the actual day isn’t listed on the invoice.

More Tips and Tricks for Getting Paid on Time

Yes, your invoice wording is extremely important when it comes to ensuring immediate payment. But it’s definitely not the only factor influencing when your clients pay their bills.

Here are five more tips to make sure your invoices are paid on time:

Tip #1: Send invoices immediately

Once a project is complete and it’s time to request payment, you might think that sending an invoice right away is overly eager or even rude.

Actually, sending your invoices as soon as possible is the best way to ensure immediate payment.

If you wait to send out your invoice, your client may have moved on to other projects and responsibilities. Instead, it’s best to request payment when you and your hard work are still fresh on the client’s mind.

Tip #2: Know your clientele

Handling invoices and payments might be a regular part of business for you. For some clients, though, the etiquette and terminology around invoicing might be a mystery.

If you feel a client might be confused by your invoice or payment terms, don’t hesitate to offer (polite) clarification. In most cases, your client will be thankful for this extra clarity when it comes to settling their balance.

Tip #3: Follow up with your clients

In many industries, Net 30 invoices are the standard. But in the business world, a lot can happen in 30 days.

If your client’s due date is approaching and you haven’t heard back from them, send them a friendly reminder about their approaching due date.

How close to your clients’ due dates you choose to send these reminders is up to you. In most cases, though, they’ll be extremely thankful for the reminder and pay their balance right away.

Tip #4: Offer payment incentives

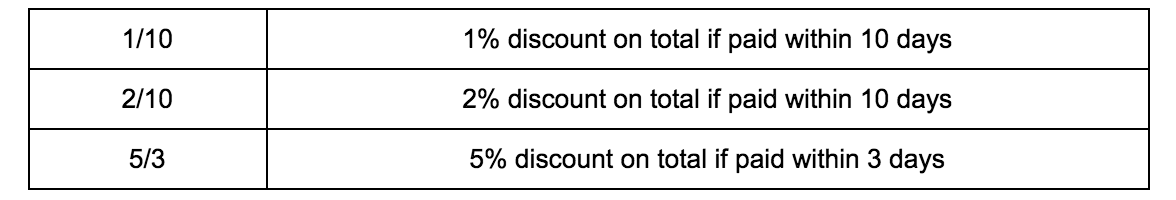

Some freelancers and business owners choose to offer financial incentives for immediate payment. Typically, this means taking a small percentage off your client’s total if they pay their bill shortly after receipt.

If you opt to include a payment incentive with your invoice, you can choose whichever terms you prefer. Some of the more common ones include:

Tip #5: Charge late fees

Opposite of early payment incentives, you can also include late fees in your contract terms.

When setting your late fee, you can choose to charge a flat rate or adjust for how long your client waits to complete their payment.

With a flat rate, your client would pay the same fee whether they pay a day or a week after the due date. But with the latter method, you could charge an extra fee for each day that the payment is late.

The benefit of charging late fees is twofold:

First, the risk of penalty for late payment will help kick procrastinating clients into gear. Second, charging a late fee will help offset the inconvenience you might face from delayed payments.

Like anything else regarding your invoice or payment terms, make sure these penalties are clear and easy to find. The last thing you want is to surprise a client with a late fee they weren’t expecting.

Easy Invoice Solutions for You and Your Clients

Keeping your invoicing system clear and straightforward isn’t just for your clients’ benefit. It can also help you stay on top of your outstanding invoices and offer a little extra peace-of-mind when handling client payments.

If you still rely on invoicing methods like plain text emails or paper bills, you’re doing things the hard way.

With invoicely, you can create professional-quality invoices with just a few simple clicks. Plus, your clients can pay their due balances directly through their invoice.

If you’re tired of mailing out invoices and chasing down client payments, it’s time to try out online invoicing from invoicely. Once you make the switch, you (and your clients) will wonder how you ever lived without it.