It’s hard to imagine what life was like for freelancers and entrepreneurs before online payment processing came along. Of these services, none is more popular than PayPal. However, many freelancers and entrepreneurs are less than thrilled about paying numerous PayPal fees for receiving money from clients.

It’s true that paying out a percentage of your income to get your money in the first place is a pain. You might even be tempted to ditch PayPal altogether for something with fewer fees.

But there’s a reason PayPal reigns supreme in the world of online payment processing.

After all, nothing is quite as convenient as a web-based payment portal that links directly to your bank account. Plus, when it comes time to request payment from a client, you want to offer them a payment method they already recognize and trust.

So are you doomed to pay out every time a client settles their invoice through PayPal? To an extent, yes.

But there are also several ways to decrease your PayPal fees for receiving money. You just need to know what to do.

What Is PayPal?

After over 20 years in business, PayPal and e-commerce pretty much go hand-in-hand. In fact, it’s hard to remember a time when you couldn’t just click a button and send money to a friend, family member, or merchant.

Instead of giving your bank account information directly to a company or individual, PayPal acts as a secure third-party. Not only does this mean your financial information stays private, but it also means you have support if something goes wrong with the transaction.

Since PayPal has been around for so long, many people take this service for granted. But as a freelancer or entrepreneur, your life would be a whole lot more difficult without this payment processing service.

Unfortunately, this convenient service also comes with some fees:

PayPal fee structure

Of course, PayPal doesn’t operate out of the goodness of its heart. To stay in business, the company needs to make some form of income off of its services.

To do this, PayPal charges a fee for most transactions that go through its system. And in most cases, these fees are charged to the person or company receiving the money.

So how much should you expect to pay each time you receive money through PayPal?

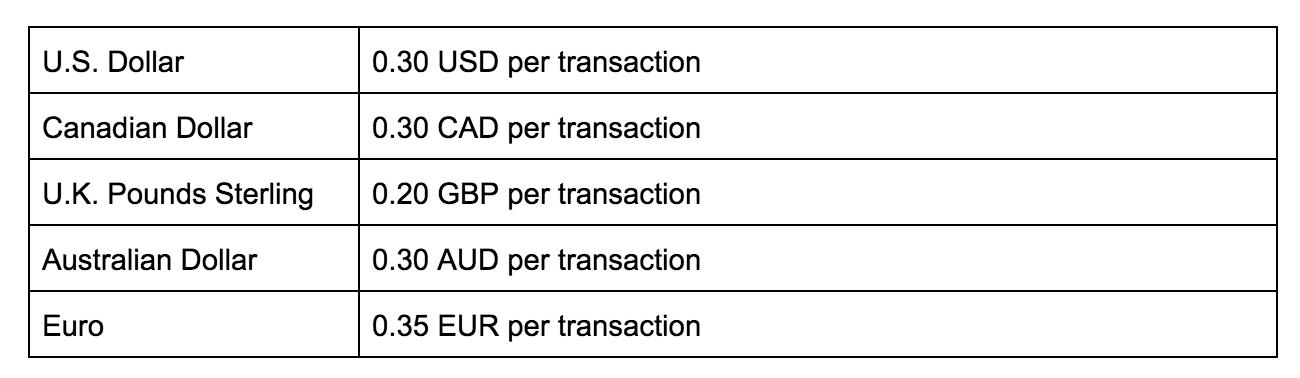

To start, PayPal applies a fixed-rate fee to each applicable transaction. This fee will vary depending on the transaction’s currency.

Some of the most popular currencies and their respective fees include:

On top of this fixed-rate fee, PayPal also charges a percentage of each transaction’s total. This percentage will vary depending on the location of your and your client’s bank accounts. Online transactions are also subject to higher fees than in-person transactions.

Assuming that you’re located within the U.S. and are accepting online payments, your fee percentage would be:

- 2.9% if your client’s bank account is within the U.S.

- 4.4% if your client’s bank account is outside the U.S.

As you can see, these variable fees take out a far larger chunk of your income than the fixed fees applied to each transaction.

Why Freelancers and Entrepreneurs Should Accept PayPal

If you’re new to freelancing or entrepreneurship, online payments might be the only method you know. But before PayPal and services like invoicely, creating, sending, and settling work invoices was a much different experience.

At first, you might look at the fees PayPal takes from your incoming payments and feel discouraged or even cheated. However, many benefits come along with these fees:

- Your clients can make (almost) instant payments

- Your clients don’t need an existing PayPal account to make payments

- You can set up an account for yourself within minutes

- PayPal charges less than many other payment services

No payment processing service is 100 percent perfect. But when it comes to offering a quick and easy-to-use system for your clients, PayPal is one of the best options around.

5 Ways to Avoid or Decrease Your PayPal Fees for Receiving Money

Charging fees to receive payment isn’t unique to PayPal.

Even brick-and-mortar retailers that accept credit cards have to pay a percentage to Visa, Mastercard, American Express, and others each time a customer uses one of these cards. But as a small freelancer or entrepreneur, these fees can feel like a major hit to your income.

Fortunately, there are several ways to cut down on PayPal fees. Here are just a few of these methods, as well as why you should or should not use them:

1. List PayPal fees as a billable expense

Perhaps the best way to offset PayPal fees for receiving money is by passing them on as a billable expense.

Whether you operate as a freelancer or small business, billable expenses are costs you contractually pass on to the client (normally by including them in the final invoice). Essentially, your client would pay the transaction fees instead of you.

For example:

Your client’s final total due is $1,300. If the client is submitting an online payment from within the U.S. (and is, therefore, subject to PayPal’s standard fees of $.30 + 2.9%), you would instead invoice them for $1,338. Once PayPal charges the applicable fees, you would be left with the original total due of $1,300.

While you need to include these expenses in your contract and let the client know what will be charged, this is a completely viable method for avoiding PayPal fees.

2. Receive fewer payments

This method is effective, but only to an extent.

By receiving fewer payments in the first place, you can avoid paying the fixed-rate fee every time. However, since each payment is still subject to the percent-based fee, you won’t save very much this way.

If you’re someone who believes every cent counts, though, this method will technically help avoid some of PayPal’s fees.

3. Request clients pay you as a friend

We’re going to list this method here because it’s a fairly common way freelancers and small businesses avoid paying additional PayPal fees. However, that doesn’t mean we condone this way of evading fees.

When someone, including a client, uses PayPal to send a payment directly, they have the option to label a transaction as personal or business-related. Unlike business-related payments, personal transactions aren’t subject to additional fees.

Again, this method of avoiding PayPal’s fees might work in the short-term. But if you are caught using this method, PayPal is likely to terminate your account completely.

In other words, please don’t try this method.

4. List PayPal fees as a business expense

We mentioned how you can pass on PayPal fees to your clients as a billable expense. However, you can also list them as a business expense on your taxes.

Business expenses allow you to deduct certain costs from your annual income. This might not seem like much at first, but tracking these expenses throughout the year can significantly lower your taxes owed.

If you choose to reduce your PayPal fees for receiving money this way, make sure you keep records of your PayPal transactions and the fees charged. You’ll need to this information is you ever undergo an audit.

5. Choose the right withdrawal method

Receiving money through PayPal means paying a few fees. But so does withdrawing that money.

While this method doesn’t deal specifically with reducing your fees for receiving money in the first place, it’s still useful information — especially if you rely on PayPal for all or most of your income.

Generally, there are two ways to move money from your PayPal balance to your checking or savings account:

First, you can transfer your chosen amount directly to a debit card. This transfer takes only a few seconds to complete. However, you’ll be charged 1 percent — but no more than $10 — for doing so.

Second, you can transfer money from your PayPal balance to your checking or savings account. This transfer can take a few days to complete. However, there is no fee for doing so.

If you use PayPal with any regularity, planning ahead can help save you quite a bit of cash.

Streamline Your Incoming Client Payments

Together with PayPal, invoicely offers a hassle-free, reliable way for clients to pay you for products or services. And when you have a whole business to run, easy is a necessity.

However, invoicely doesn’t just help you create pro-quality invoices. It also lets you include a direct PayPal link in each of your invoices, making your client’s lives just that much easier.

Plus, even your clients who don’t already have a PayPal account can quickly and seamlessly settle their invoices through this link. All they need to do is enter their payment information and click a button.

Learn more about incorporating PayPal into your client payment system with invoicely.